The Fund

WIC employs a bottom-up fundamental investing approach to every investment. Each idea begins with a screening process to find stocks that are trading below their intrinsic value. Our analysts then conduct an extensive research procedure to understand and evaluate the company. The process can sometimes take months for a single idea. WIC attempts to truly understand a company’s valuation as well as the key drivers of its future growth potential before executing a trade. We believe that by conducting an exhaustive research process, we minimize the risk of unforeseen challenges.

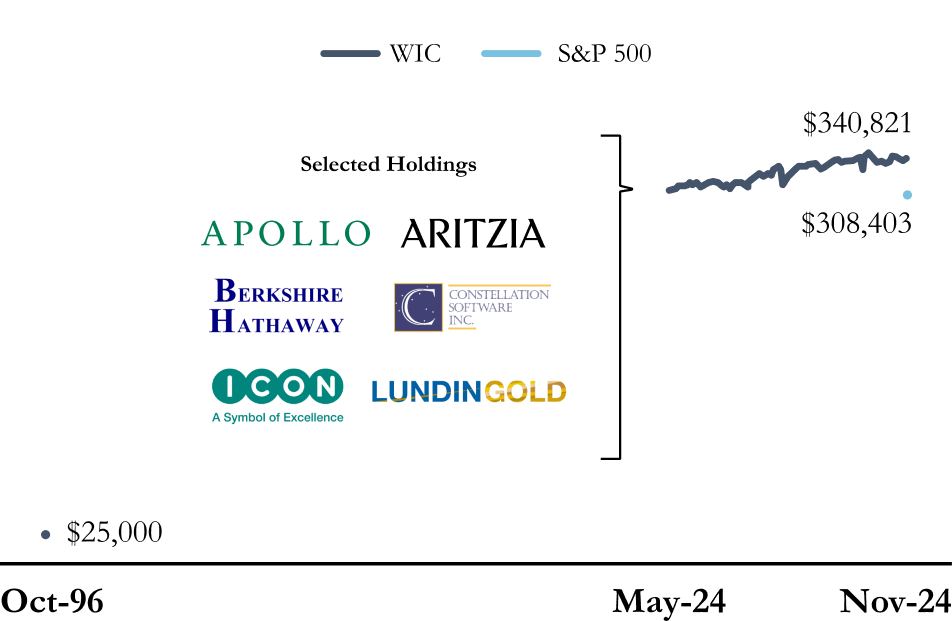

Fund Performance

Since its inception in 1996, WIC’s Fund has demonstrated exceptional growth, outperforming the S&P 500. With a starting portfolio of $25,000, the fund has grown to $340,821 as of November 2024, driven by strategic investments in leading companies such as Apollo, Aritzia, and Berkshire Hathaway.

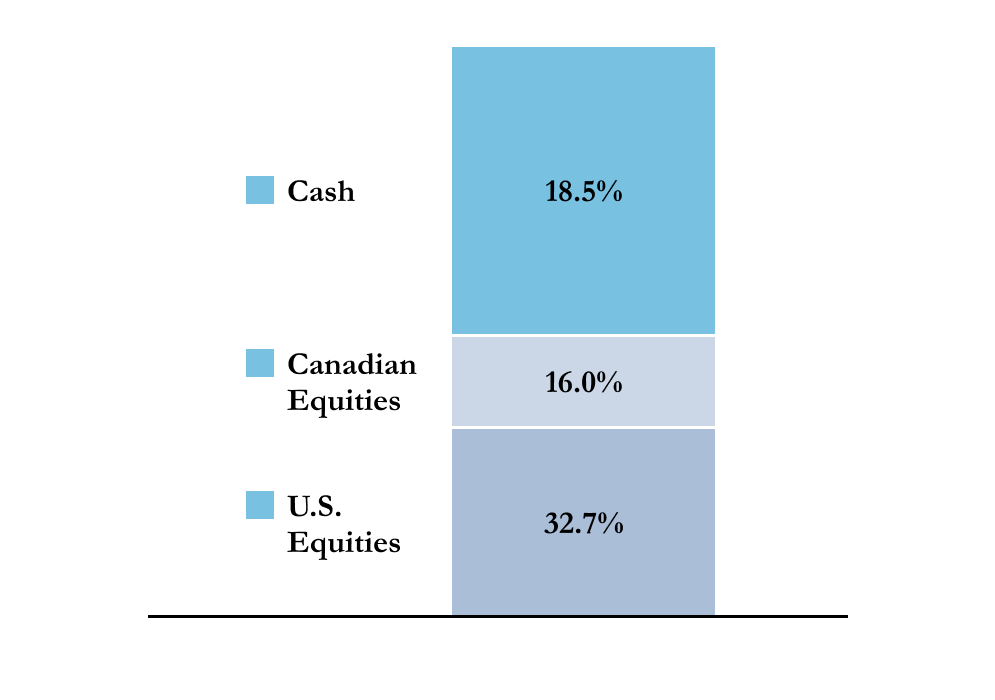

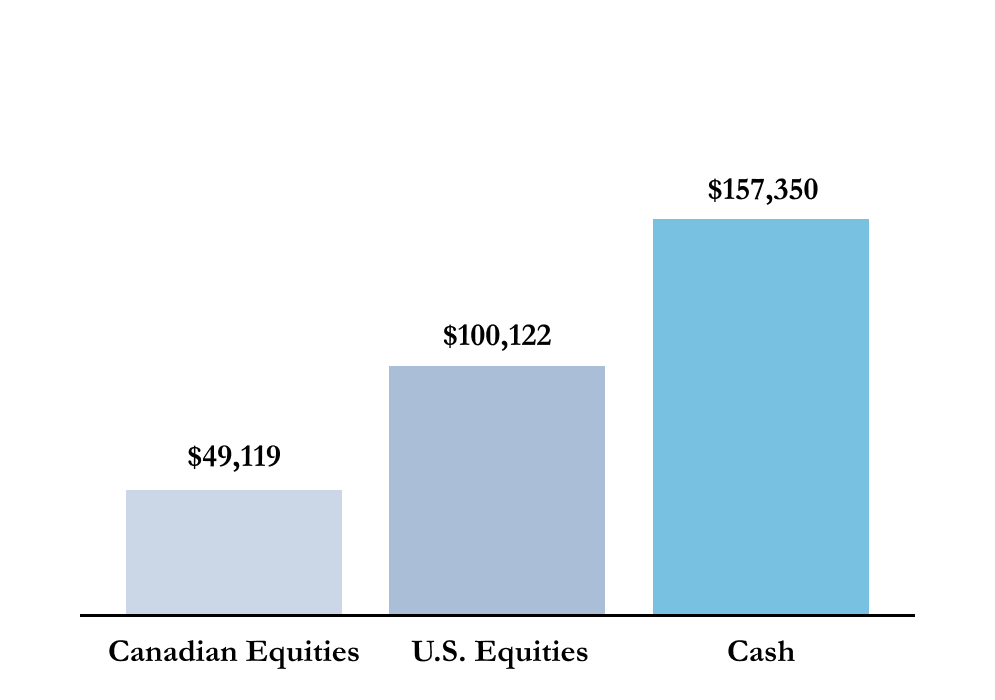

Portfolio Snapshot

In 2024, WIC decided to cut legacy holdings we no longer believed had the long-term growth potential possessed when we initially invested. This led to a significant revamp of the portfolio, with the disposal of 17 holdings and the entry of 6 new investments (3 in Healthcare; 1 in Real Assets, 1 in Tech, Media, and Telecom; and 1 in Financial Institutions) during the 2023 - 2024 academic year. This has helped add higher quality and higher-yielding assets to the portfolio while shedding underperforming assets.

WIC’s portfolio comprises cash, U.S. equities, and Canadian equities. The fund faces foreign exchange risk given significant U.S. equity holdings and does not take action to hedge USD exposure. Cash is held in a Canadian dollar savings account allowing for immediate withdrawals.

Annual Report

Buy/Sell Presentations

In order to manage our portfolio and educate members, WIC makes buy and sell pitches on a weekly basis. Find below a historical database of pitches that WIC analysts and researchers have put together. The following presentations are abbreviated versions. Presentations here do not accurately reflect the current holdings in the WIC portfolio.